In this article, I share my personal experience in navigating this intricate process, shedding light on how I added my tax information by furnishing a tax residency certificate from the Swedish Tax Agency and filling out the requisite forms.

While I believe my approach to be accurate, it's essential to acknowledge the complexity of tax regulations and the possibility of individual variation.

If you're uncertain about why or how you specifically need to provide Ireland tax information, it's best to consult with a tax advisor for clarification based on your individual circumstances.

Why do I have to do this?

Google AdSense, like many advertising platforms, requires tax information from its users for legal and regulatory compliance purposes. This includes information about your tax status in various jurisdictions, including Ireland if applicable.

Additionally, Google AdSense may require tax information to ensure that they are withholding the correct amount of taxes from your earnings, as required by tax authorities. This helps both you and Google ensure compliance with tax laws and regulations.

How it started

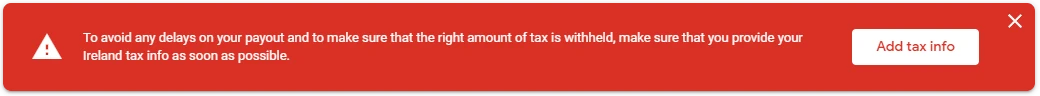

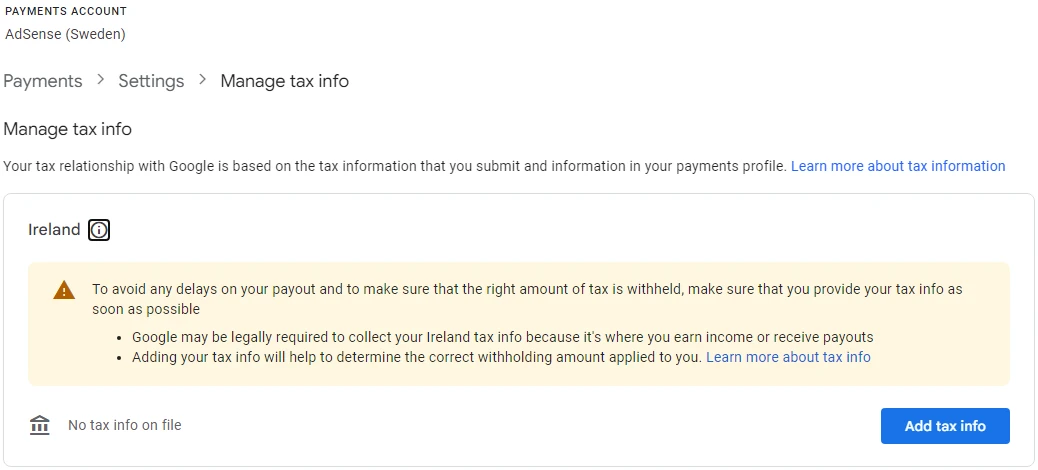

One day, as I logged into my AdSense account, I was greeted by a message that had never appeared before. It caught my attention immediately, prompting a flurry of curiosity and a hint of confusion as I read its contents:

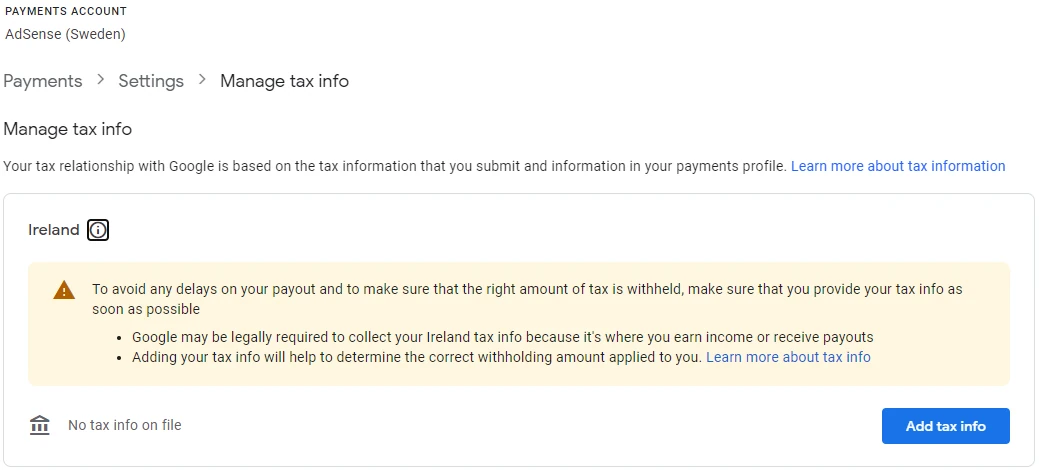

Naturally, I clicked the button, eager to uncover more information, and was promptly greeted with more details:

To avoid any delays on your payout and to make sure that the right amount of tax is withheld, make sure you provide your Irelend tax info as soon as possible.

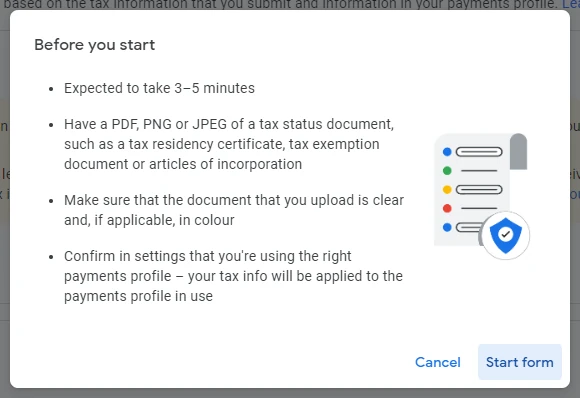

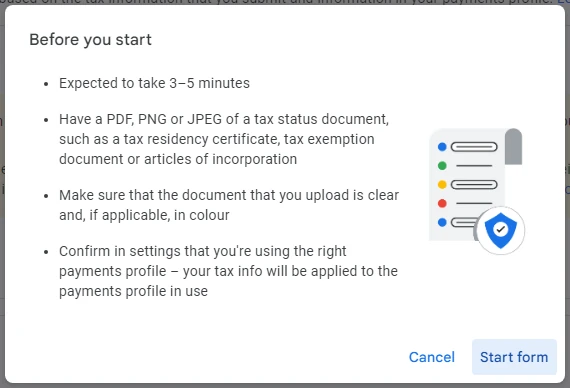

Clicking the button, I awaited the next prompt, only to have a popup show up with further instructions:

I did not have a tax residency certificate for my company so I stopped there and tried to figure out how to get one.

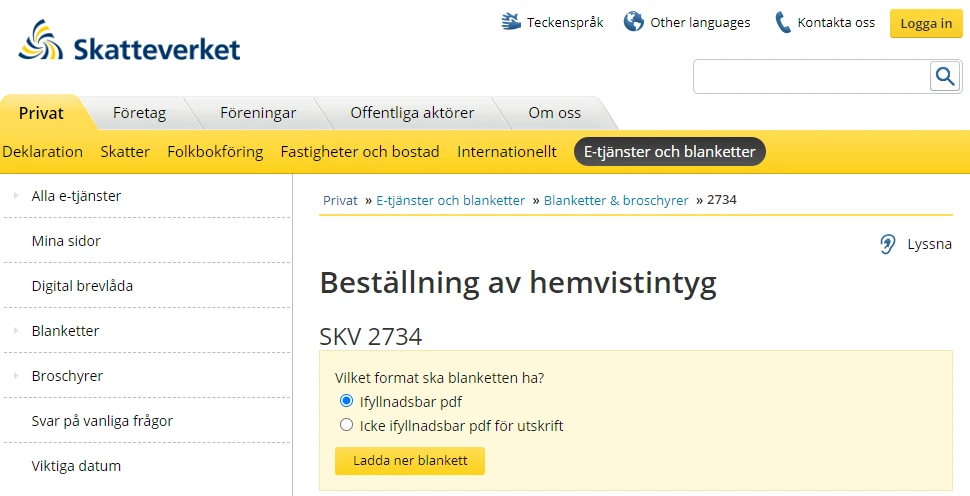

After a breif search, I found this page (SKV2734 Beställning Hemvistintyg) at the Swedish Tax Agency (Skatteverket) where you can get a form to request the certificate.

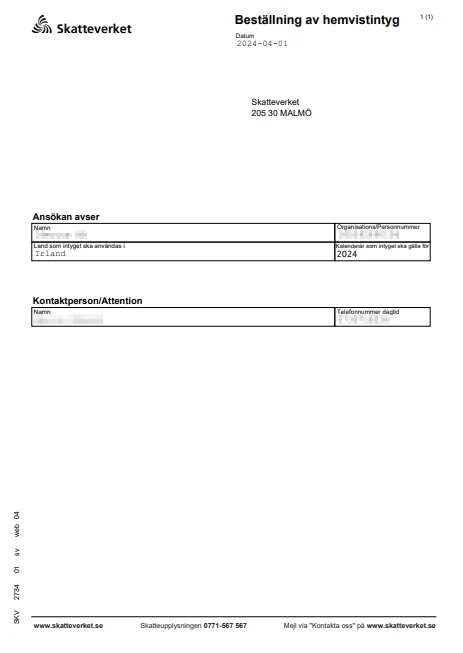

After I filled it in, it looked like this (with some personal info pixellated):

I saved that filled out PDF form locally. Next, I sent the document as an email attachment to the email adress hemvistintyg@skatteverket.se and was greated with a auto-reply immediately stating that it would take some time before it can be processed:

Confirmation

We have received your e-mail and we will give you an answer as soon as possible. If you have further contact with Swedish Tax Agency regarding this matter, please state the case number: XXXXXXXXXXXXX.

The processing time for a certificate issued by The Swedish Tax Agency is currently about 3 weeks. For foreign forms, the processing time is about 5 weeks.

How we process personal data in your email:

If your email contains personal data, we usually use it only to answer your questions. If your email is about an ongoing case, we may use the personal data in administering the case.

Here, you can find out how the Swedish Tax Agency processes personal data:

skatteverket.se/processingofpersonaldata

Best regards,

Swedish Tax AgencySo I simply waited for the certificate to show up after that.

Actually adding my tax info

After patiently waiting for about three weeks, the tax residency certificate (hemvistintyg in Swedish) finally arrived at my doorstep in the form of a stamped paper certificate. While there's an option to receive a digital copy sent to a digital mailbox, I opted for the traditional route and used my scanner to digitize the paper version. With the certificate in hand, I felt much more prepared to tackle the process once more.

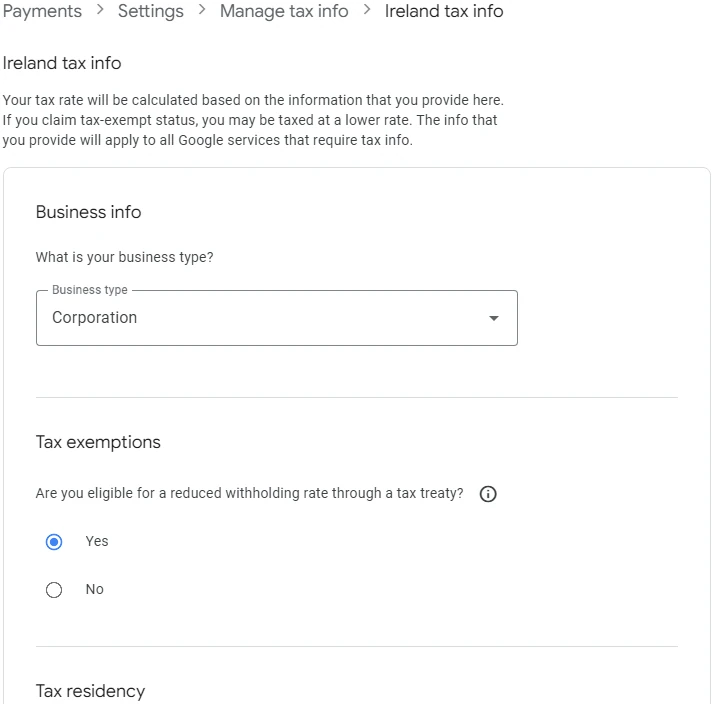

So, as I began filling out the actual tax info form, I selected "Corporation" from the dropdown menu. But then, my eyes landed on the "Tax exemptions" header, and I found myself scratching my head once again.

I was initially uncertain about whether there was a tax treaty for a reduced withholding rate. However, a quick search provided me with multiple pages confirming the existence of such a treaty. The first result I clicked on led me to this page: https://taxsummaries.pwc.com/sweden/corporate/withholding-taxes. As I delved into the content, I felt increasingly confident that I could answer "YES" to the treaty question.

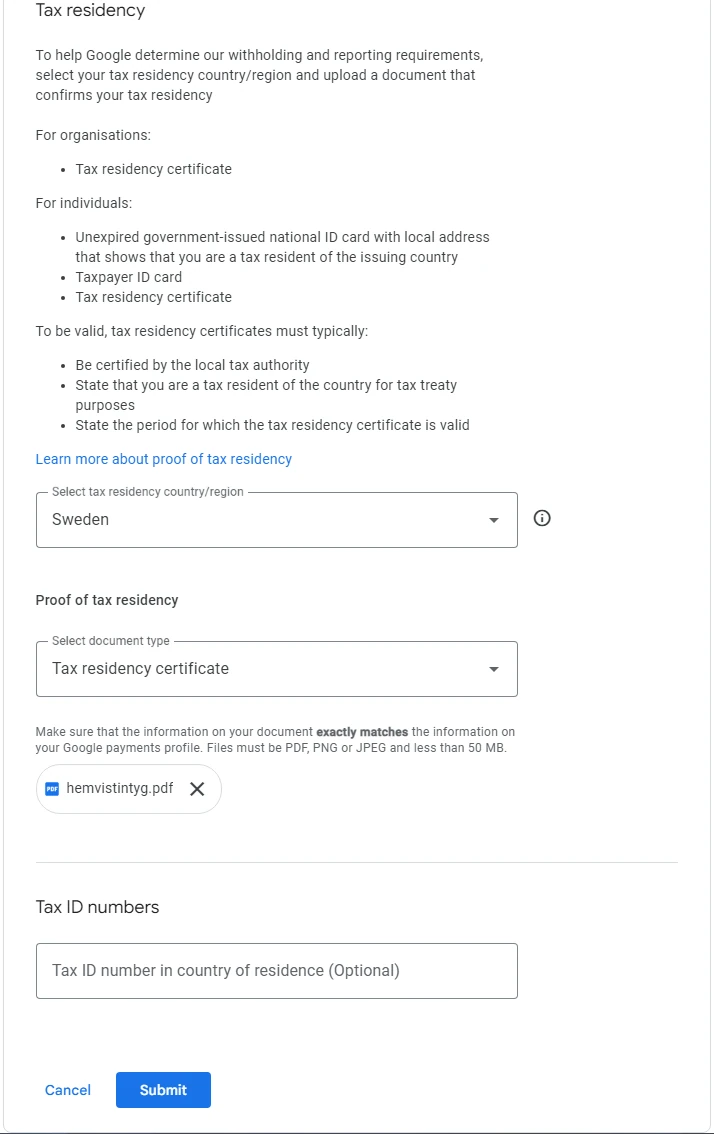

Scrolling down, there was an upload function where I added my scanned certificate and uploaded it. With that done, this is how that looked:

I did not add a Tax ID number in the final (optional) textbox since that is already included in the tax residency certificate.

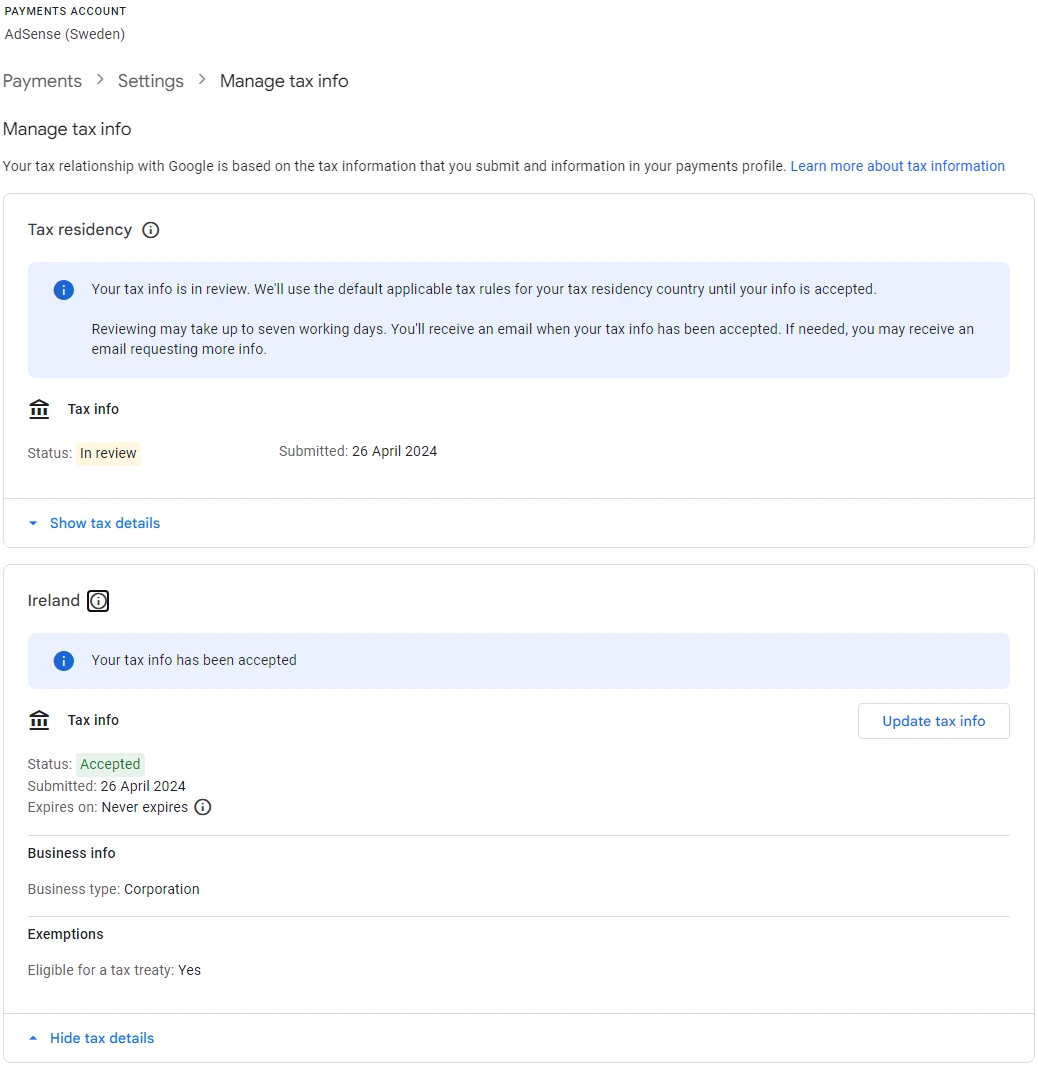

After filling out all the necessary details, I hit the submit button and found myself back on the main page of the "manage tax info" section. Lo and behold, one of the boxes had already been updated and was instantly marked as Accepted.

Around that time, I happened to notice something interesting in my inbox: three confirmation emails from Google. Surprisingly, they popped up just within a minute after I entered the tax info.

Your tax residency tax information has changed

Your Ireland tax information has been accepted

Your tax residency tax information has been accepted

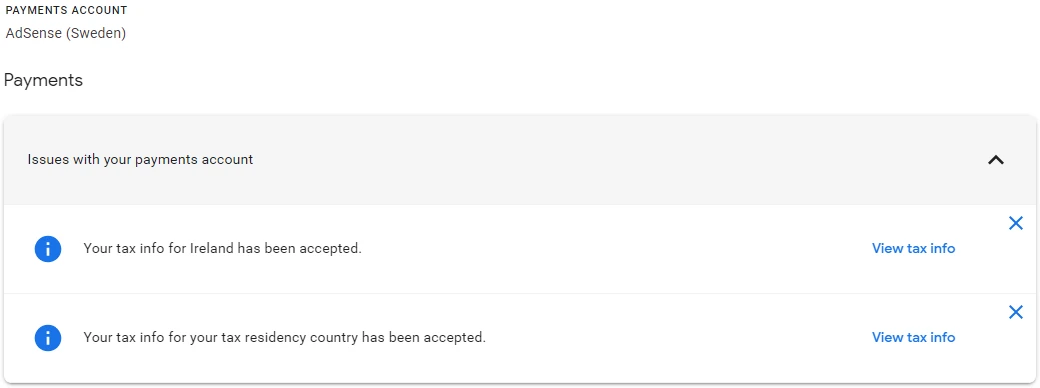

The front page for "Payments info" also updated with information "issues".

And after about another minute, the "Manage tax info" was updated to have the status changed to Accepted for both boxes. So it looks like this right now:

And that's a wrap! Google's part of the process was super quick, but I had to twiddle my thumbs for about three weeks waiting for the tax residency certificate to finally show up in my mailbox.

Summary

All things considered, it wasn't too much trouble, but it did eat up some time while I tried to sort it all out. I'm pretty sure I got it right, like around 90 percent sure, but when it comes to my company stuff, it still leaves me a tad uncertain. Mainly, I wrote this post to keep track of what I did this year, just in case I need to go through the same process again in the future. Hopefully, my experience here helps you out a bit. But if you're still feeling iffy, it's probably best to chat with a tax advisor who can give you personalized advice. Your situation might need a pro's touch for that extra peace of mind.